Indices

Friday, November 11, 2022

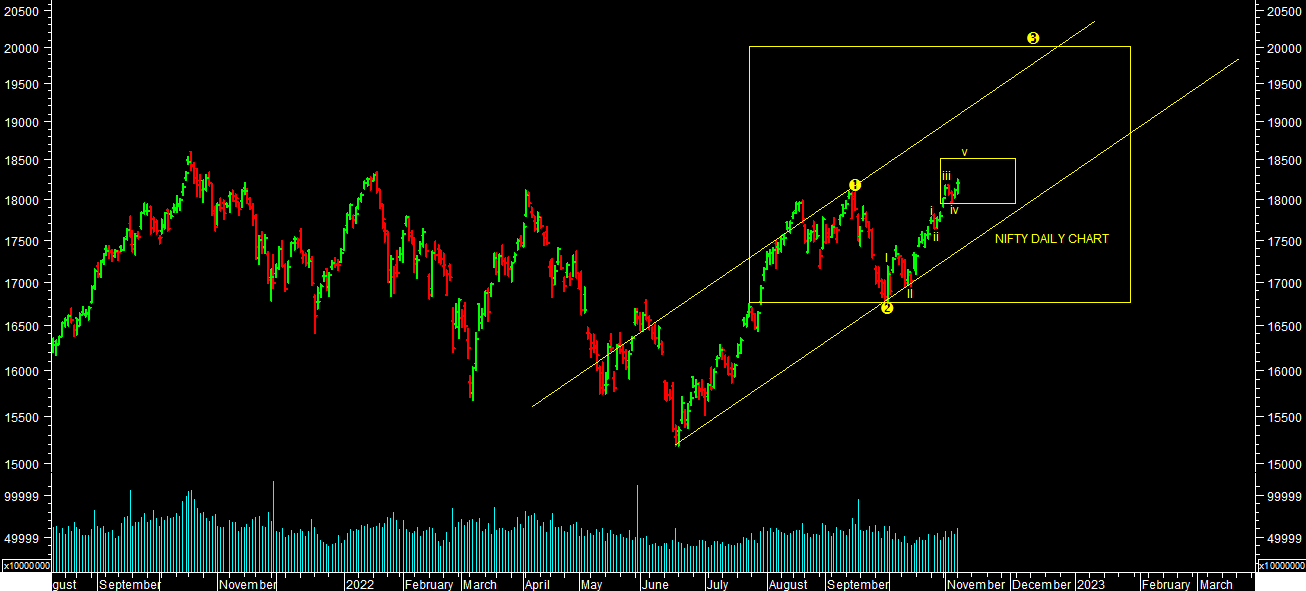

INDICES:BULL MARKET CONTINUATION FURTHER AFTER TIME WISE CONSOLIDATION/ CORRECTIVE PHASE OF ONE YEAR:

Sensex & Nifty closed 61795.04 levels & 18349.70 levels on 11.11.2022. We have seen Pause of around one year in Bull Market which has started after Covid Crash in March 2020. Nifty consolidated between range of around 15000-18000 levels for period of one year from October 2021 to October 2022.

We are seeing break out of these Time wise consolidation/ Corrective phase range after period of one year now. It looks like case for BULL MARKET CONTINUATION FURTHER AFTER PAUSE OF ONE YEAR.

Any Bull market witnesses some kind of consolidation/corrective phase after sharp surge which was the case here. We have witnessed time wise consolidation /corrective phase after sharp surge since covid crash.

The reason for this correction is Global. It's mainly Inflation, Recessionary worry across globe, Russia-ukrain War, supply chain disruption, $$ Appreciation due to hike in Interest rates by central bankers across the globe etc. Global Market witnessed sharp correction but India has outperformed among world Markets.

It looks like possibility of sharp pullback rally across the global Indices at current levels of markets and which will fuel further on going out performance of Indian Equity Markets particularly main bench mark indices. And we will see higher levels targets in Indian bench mark indices in medium term.

Nifty is heading towards 20500 levels & sensex towards 68500 levels in medium term as per chart attached. 16747 levels on nifty & 56147 levels on sensex respectively is a strong support / Reversal levels for the same. Till it holds one can expect Market to trend towards higher levels targets in medium term. One can buy Stock specific in any kind of correction or consolidation phase till medium term reverses.

Conclusively, as expected earlier about one more pending phase of market which looks like started now. One should focus more on buy side with patience in this phase of market. I am confident that Investor will earn decent return on Index levels in general & stock specific levels in particular.