Market Outlook

FRIDAY, MARCH 03, 2023

Market Outlook (Closing) as on 03.03.2023

Market closed in positive territory at 59808.97 (+899.62)

PULL BACK RALLY IN SHORT TERM:

MEDIUM TERM TREND CHANGING TO DOWN TILLIT REVERSES: LOOKS LIKE TIME WISE CORRECTIVE/CONSOLIDATION PHASE IN MARKET:

MARKET MAY CONSOLIDATE IN RANGE FOR SHORT TO MEDIUM TERM:

ANY KIND OF SHORT TO MEDIUM TERM CORRECTION OR CONSOLIDATION IS A BUYING OPPORTUNITY FROM LONG TERM INVESTMENT PERSPECTIVES:

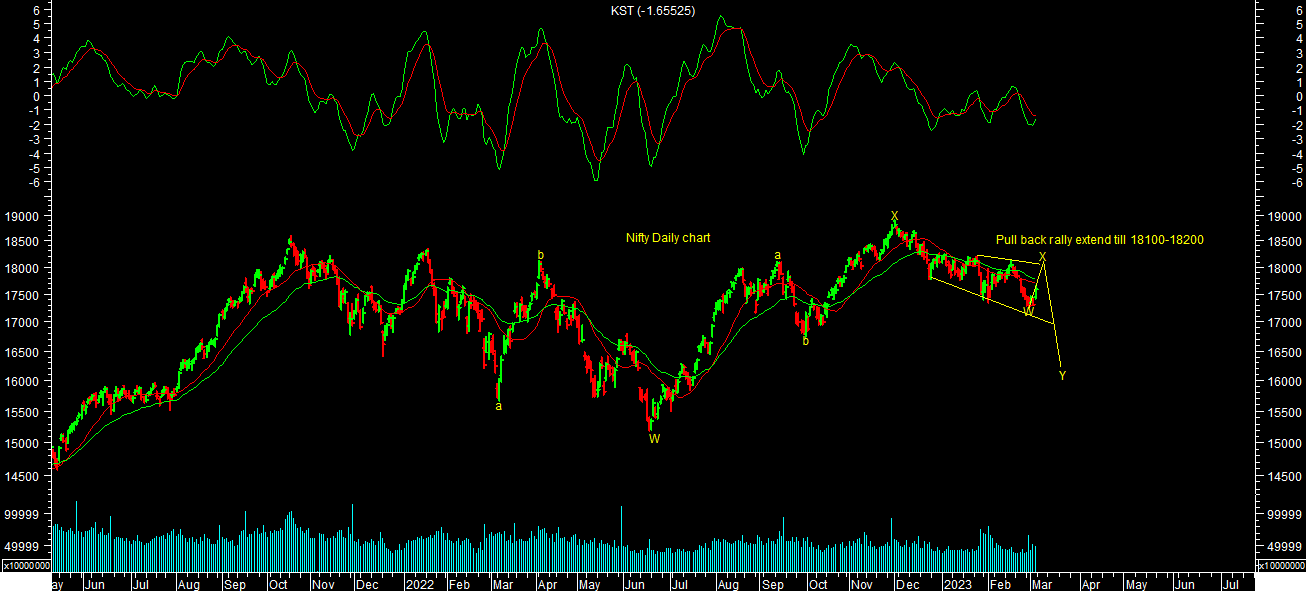

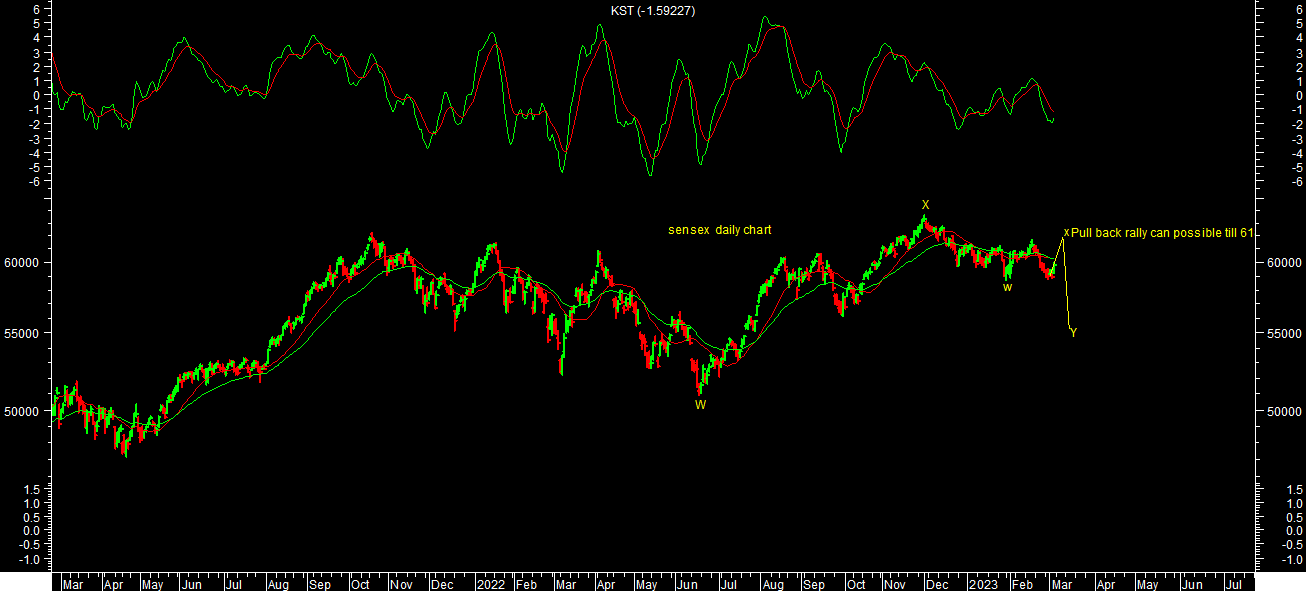

Market sharply recovered from lower levels. It closed weekly in positive territory. It made a low of 17255 levels on nifty & 58699 levels on sensex. It look like possibility of pull back rally towards higher levels targets as mentioned below in short term till it reverses. Market ma consolidate in range for short term between 17200-18200 levels on nifty. Trader should be stock specific & follow trend till it reverses.

It looks like medium term time wise corrective phase in the market. We may see Market to trend in short term range of 17250-18000/18200 levels & 16750- 18300 levels medium term perspectives. Market will take a clues from global market in short term. Wave count looks like medium term time wise corrective or consolidation phase in market till it reverses.

Bank nifty is out performing in short term. It also sharply reversed from lower levels. It made a low of 39419.80 levels. It also closed weekly in positive territory. Short term trend on bank nifty remains positive till it trades above 40000 levels & expect target around 42500 to 43000 levels in short term. Medium term trend remains down till bank nifty trades below 43000 level & expect target around 37400 levels in medium term. We may some kind of consolidation between 39500 to 42500/43000 levels in short term & 37400 to 42500/43000 levels from medium term perspectives till it reverses.

17000/18000 is strong support & Resistance levels respectively based on option open interest data for current month series so far from expiry perspectives. It looks Time wise corrective or consolidation phase for medium term perspectives so far till it reverses. Investor should this as opportunity to buy stock specific for higher levels targets in medium term.

Momentum indicators Daily KST is in BUY & Daily MACD is in sell indicating volatility in short term. Break of short term reversal levels will lead to further sharp sell off towards 17000/16750 levels on nifty & 57000/56000 levels on sensex in short term. Investor should use any kind of correction or consolidation to buy stock specific in tranches in disciplined manner from medium to long term perspectives till it reverses.

Momentum Perspective:

Weekly KST & Weekly MACD both are in SELL. Market closed above 20WESM & 40 WEMA. It looks like Time wise medium term corrective phase in market till we get further confirmation of trend reversal.

Conclusion:

Short Term Trend is UP & Medium term Trend is DOWN

Trend

Market Outlook (Closing) as on 03.03.2023

Market closed in positive territory at 59808.97 (+899.62)PULL BACK RALLY IN SHORT TERM:

MEDIUM TERM TREND CHANGING TO DOWN TILLIT REVERSES: LOOKS LIKE TIME WISE CORRECTIVE/CONSOLIDATION PHASE IN MARKET:

MARKET MAY CONSOLIDATE IN RANGE FOR SHORT TO MEDIUM TERM:

ANY KIND OF SHORT TO MEDIUM TERM CORRECTION OR CONSOLIDATION IS A BUYING OPPORTUNITY FROM LONG TERM INVESTMENT PERSPECTIVES:

Market sharply recovered from lower levels. It closed weekly in positive territory. It made a low of 17255 levels on nifty & 58699 levels on sensex. It look like possibility of pull back rally towards higher levels targets as mentioned below in short term till it reverses. Market ma consolidate in range for short term between 17200-18200 levels on nifty. Trader should be stock specific & follow trend till it reverses.

It looks like medium term time wise corrective phase in the market. We may see Market to trend in short term range of 17250-18000/18200 levels & 16750- 18300 levels medium term perspectives. Market will take a clues from global market in short term. Wave count looks like medium term time wise corrective or consolidation phase in market till it reverses.

Bank nifty is out performing in short term. It also sharply reversed from lower levels. It made a low of 39419.80 levels. It also closed weekly in positive territory. Short term trend on bank nifty remains positive till it trades above 40000 levels & expect target around 42500 to 43000 levels in short term. Medium term trend remains down till bank nifty trades below 43000 level & expect target around 37400 levels in medium term. We may some kind of consolidation between 39500 to 42500/43000 levels in short term & 37400 to 42500/43000 levels from medium term perspectives till it reverses.

17000/18000 is strong support & Resistance levels respectively based on option open interest data for current month series so far from expiry perspectives. It looks Time wise corrective or consolidation phase for medium term perspectives so far till it reverses. Investor should this as opportunity to buy stock specific for higher levels targets in medium term.

Momentum indicators Daily KST is in BUY & Daily MACD is in sell indicating volatility in short term. Break of short term reversal levels will lead to further sharp sell off towards 17000/16750 levels on nifty & 57000/56000 levels on sensex in short term. Investor should use any kind of correction or consolidation to buy stock specific in tranches in disciplined manner from medium to long term perspectives till it reverses.

Momentum Perspective:

Weekly KST & Weekly MACD both are in SELL. Market closed above 20WESM & 40 WEMA. It looks like Time wise medium term corrective phase in market till we get further confirmation of trend reversal.Conclusion:

Short Term Trend is UP & Medium term Trend is DOWN

Trend

| Short Term : | Trend | Reversal |

| 61800 |  | 58700 |

| Medium Term : | Trend | Reversal |

| 56000 |  | 58700 |

| Short Term : | Trend | Reversal |

| 18000/18200 |  | 17250 |

| Medium Term : | Trend | Reversal |

| 16750 |  | 18300 |