Stocks

FRIDAY, AUGUST 12, 2016

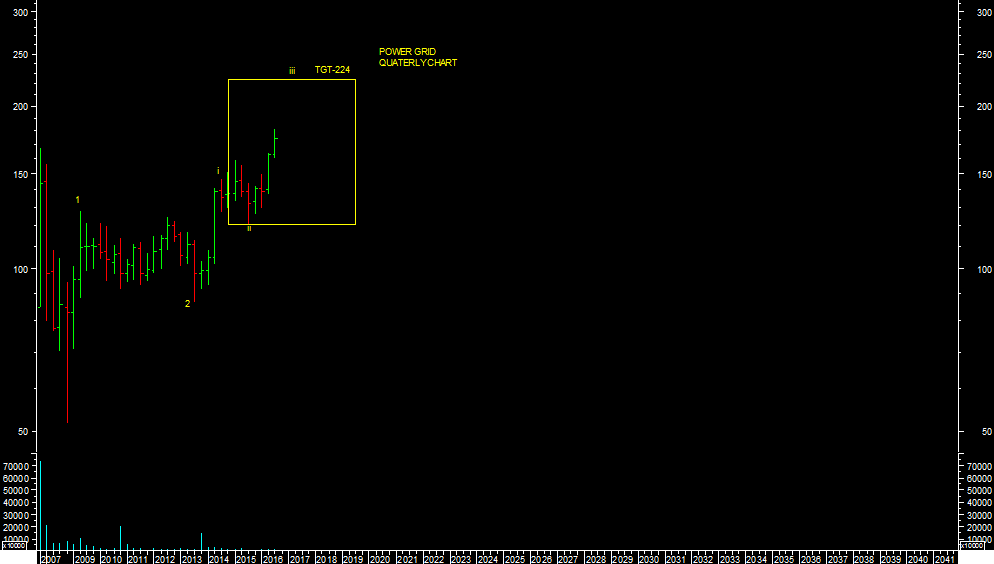

VIEW POINT: (Investment Ideas) - From wave count perspectives:

1. POWER GRID: CMP-176

It looks like beginning of wave-iii of 3 upwards rally for power grid at current levels as per quarterly chart attached. One can BUY with SL-146 for the higher levels targets of 224 initially in Medium term.

2. BHARAT FORGE: CMP-823

It has wave-V up pending as per quarterly chart attached. It may be high possibly of completion of wave-IV correction at recent bottom. Risk reward is favourable to BUY at current levels. One can BUY with SL-600 for the higher levels targets of 1400++ initially in medium term.

3. TCS- CMP-2732

TCS has wave-V up pending at current levels. It may be high possibility of end of wave-IV correction or consolation. Risk reward is favourable to BUY at current levels. One can BUY with SL-2400 levels for the targets of 3050-3250 levels initially in medium term.