Stocks

THURSDAY, APRIL 13, 2017

VALUE WAVE INVESMENT STOCK IDEAS:

TECHNO-FUNDA MEDIUM TO LONG TERM INVESTMENT IDEAS:

L&T:

CMP-1678

L&T looks started its long term wave-V up after last 8 years of triangular consolidation in wave-IV as per long term chart attached. It has started impulsive trend from recent bottom of around 1300 as per chart attached. Its equality target1 comes to around Rs-2200/2300 as per chart attached & extend target2 comes in the range of around Rs-3300/3500. Its value wave funda-techno investment idea for medium to long term investor from both fundamental & Technical perspectives

The stocks too have good order book & execution capabilities as per historic track record.

One should buy at current market price or any kind of decline or consolidation with SL-1300 for such positional targets in medium to long term. Risk reward is favourable to buy at current levels. One should keep time horizon for around 2-3 years for such targets.

CUMMINS INDIA:

CMP-978

CUMMINS INDIA looks started its long term wave-(v) of III as per long term quarterly chart attached. It has started impulsive trend from recent bottom of around 747 as per chart attached. Its equality target1 comes to around Rs-1250/1300 as per chart attached & extend target2 comes in the range of around Rs-1700. Its value wave funda-techno investment idea for medium to long term investor from both fundamental & Technical perspectives

The stocks too have good revenue visibility & good fundamental trace records so far from earning perspectives.

One should buy at current market price or any kind of decline or consolidation with SL-750 for such positional targets in medium to long term. Risk reward is favourable to buy at current levels. One should keep time horizon for around 2-3 years for such targets.

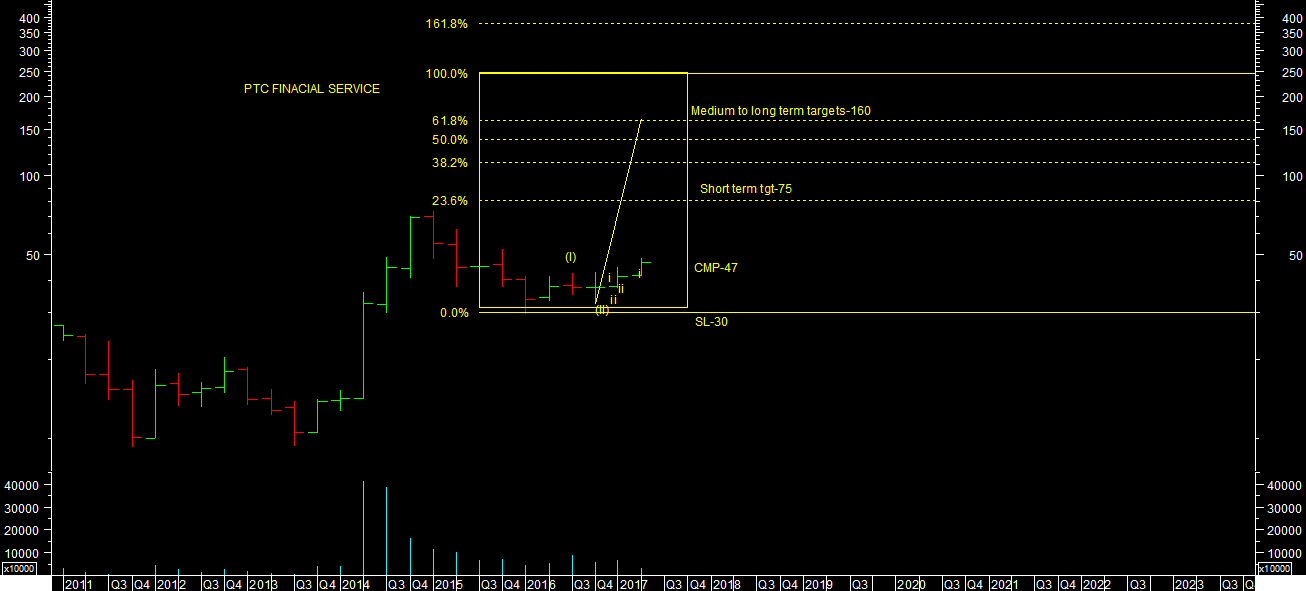

PTC FINANCIAL SERVICE:

CMP-47

PTC FINANCIAL SERVICES looks started its long term wave- III as per long term quarterly chart attached. It has started impulsive trend from recent bottom of around 30 as per chart attached. Its equality target1 comes to around Rs-75 as per chart attached & extend target2 comes in the range of around Rs-165. Its value wave funda-techno investment idea for medium to long term investor from both fundamental & Technical perspectives

The stocks looks good by considering growth in capex growth on power sector as a whole from fundamental perspectives as well.

One should buy at current market price or any kind of decline or consolidation with SL-30 for such positional targets in medium to long term. Risk reward is favourable to buy at current levels. One should keep time horizon for around 2-3 years for such targets.