Currencies

FRIDAY, SEPTEMBER 23, 2022

Rupee

Rupee

USD/INR

CMP-$81.25 (23.09.2022) - VIEW POINT

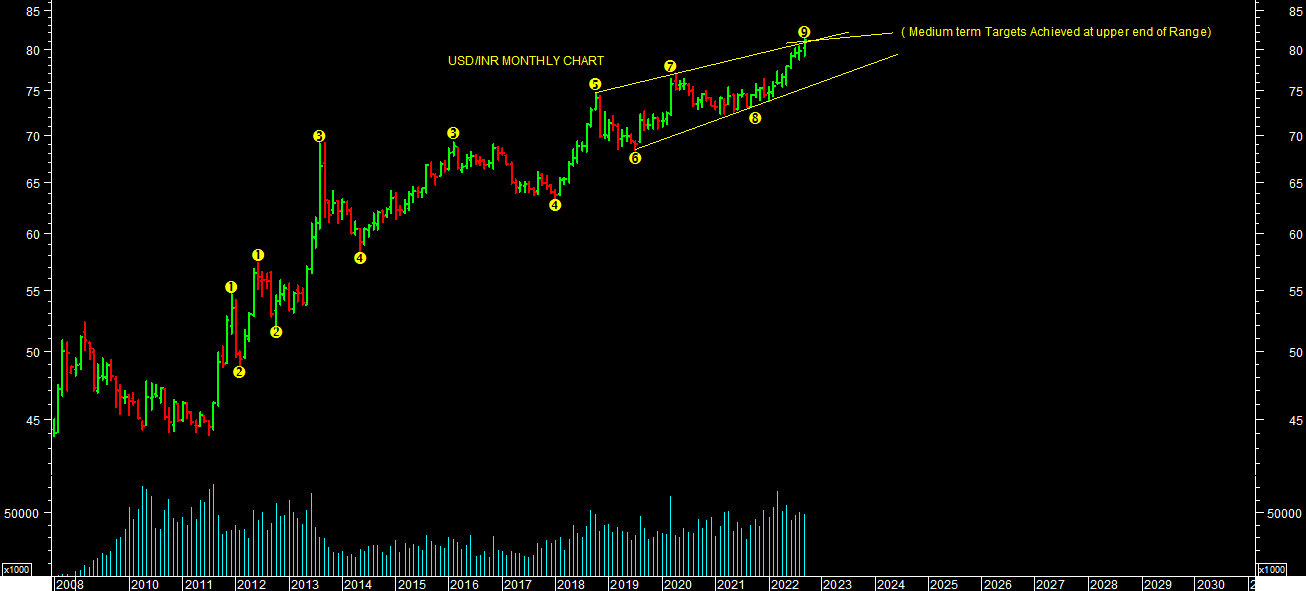

USR/INR closed @$81.25 as on 26.04.2022. It has achieved my medium term targets levels as expected earlier. In fact it's stretching further more in near term. It made a high of $81.26 levels so far in this rally. It looks like its final climax targets zone of medium term corrective phase. In that case it can further stretch till $81.80 to $82.25 sharply in coming days. Its final wave wise targets levels as per chart attached for short to medium term perspectives in case of extension.

DXY also near upper end of channel towards final climax targets zone of medium term corrective phase. In that case it can further stretch till 114-115 sharply in coming days. Its final wave wise targets levels as per chart attached for short to medium term perspectives in case of extension.

Therefore, USD/INR & DXY both are overdone & conclusively at near very crucial medium term targets zone. One should book profit or Trail till it reverses at these levels, Its final wave wise targets levels as well for medium term perspectives as current levels.

It has a strong support/reversal around $80 in short-term. Break of it will lead to sharp fall towards $77 can possible in short term.

$77 is final Medium term reversal levels to conclude medium term reversal in USD/INR.

Conclusively, there not much more room for USD/INR to depreciate from here on for medium term perspectives as per chart attached on at this climax targets zone.

USD/INR

CMP-$81.25 (23.09.2022) - VIEW POINT

TREND TOWARDS FINAL CLIMAX TARGETS ZONE OF MEDIUM TERM CORRECTIVE PHASE:

DXY ALSO NEAR UPPER END OF CHANNEL TOWARDS FINAL CLIMAX TARGETS ZONE OF MEDIUM TERM CORRECTIVE PHASE:

BOOK PROFIT OR TRAIL TILL IT RESERSES AT THIS UPPER END OF FINAL MEDIUM TERM TARETS LEVELS

USD/INR & DXY BOTH ARE OVERDONE & ALSO NEAR FINAL WAVE WISE TARGETS LEVELS FOR MEDIUM TERM PERSPECTIVES:

CONCLUSIVELY NOT MUCH MORE ROOM FOR USD/INR TO DEPRICIATE FROM HERE ON FOR MEDIUM TERM PERSPECTIVES

USR/INR closed @$81.25 as on 26.04.2022. It has achieved my medium term targets levels as expected earlier. In fact it's stretching further more in near term. It made a high of $81.26 levels so far in this rally. It looks like its final climax targets zone of medium term corrective phase. In that case it can further stretch till $81.80 to $82.25 sharply in coming days. Its final wave wise targets levels as per chart attached for short to medium term perspectives in case of extension.

DXY also near upper end of channel towards final climax targets zone of medium term corrective phase. In that case it can further stretch till 114-115 sharply in coming days. Its final wave wise targets levels as per chart attached for short to medium term perspectives in case of extension.

Therefore, USD/INR & DXY both are overdone & conclusively at near very crucial medium term targets zone. One should book profit or Trail till it reverses at these levels, Its final wave wise targets levels as well for medium term perspectives as current levels.

It has a strong support/reversal around $80 in short-term. Break of it will lead to sharp fall towards $77 can possible in short term.

$77 is final Medium term reversal levels to conclude medium term reversal in USD/INR.

Conclusively, there not much more room for USD/INR to depreciate from here on for medium term perspectives as per chart attached on at this climax targets zone.