Indices

Friday, January 27, 2017

INDICES:INDICES:

SHARP MEDIUM TERM REVERSAL: BULLS ARE BACK.

BEGINNING OF WAVE-III OF V OR WAVE-III UP FROM LONG TERM WAVE COUNTS PERSPECTIVES.

OPPORTUNITY FOR MEDIUM LONG TERM INVESTOR ONCE AGAIN TO BUY STOCK SPECIFIC AT CURRRENT LEVELS OR ANY KIND OF DECLINE OR CONSOLIDATION FOR HIGHER LEVELS TARGETS IN MEDIUM TO LONG TERM:

Nifty & sensex closed 8641.25 & 26,882.46 respectively on 27.01.2017. It has finally confirmed end of medium term correction near recent lows. It made a low of 7893 levels on nifty & 25,807.10 levels on sensex on 26/12/2016. One should expect market to trend towards higher levels in medium to long term till it reverses.

It has retraced around 50% near recent lows in this correction. I was anticipating these medium term correction to extend further towards lower levels targets as per my earlier view but surprisingly it has sharply reverse & closed above my medium reversal levels of 8600 levels on nifty & 27,774 levels on sensex at the end of weekly trading session. BULLS ARE BACK once again for medium term perspectives at current levels of market.

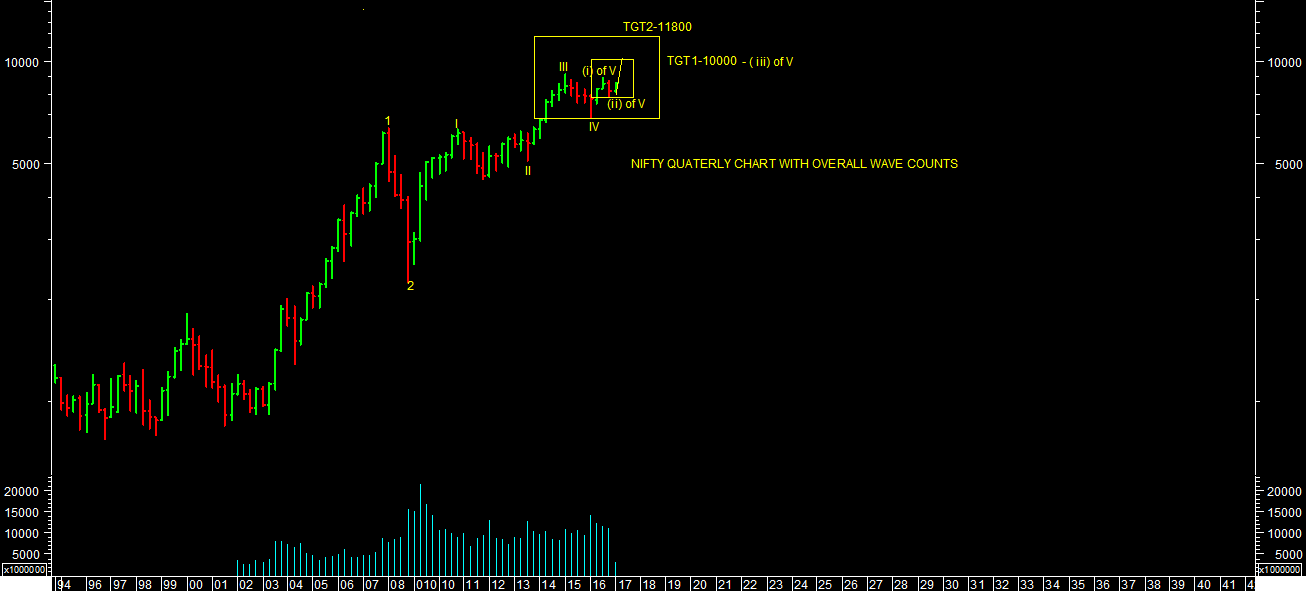

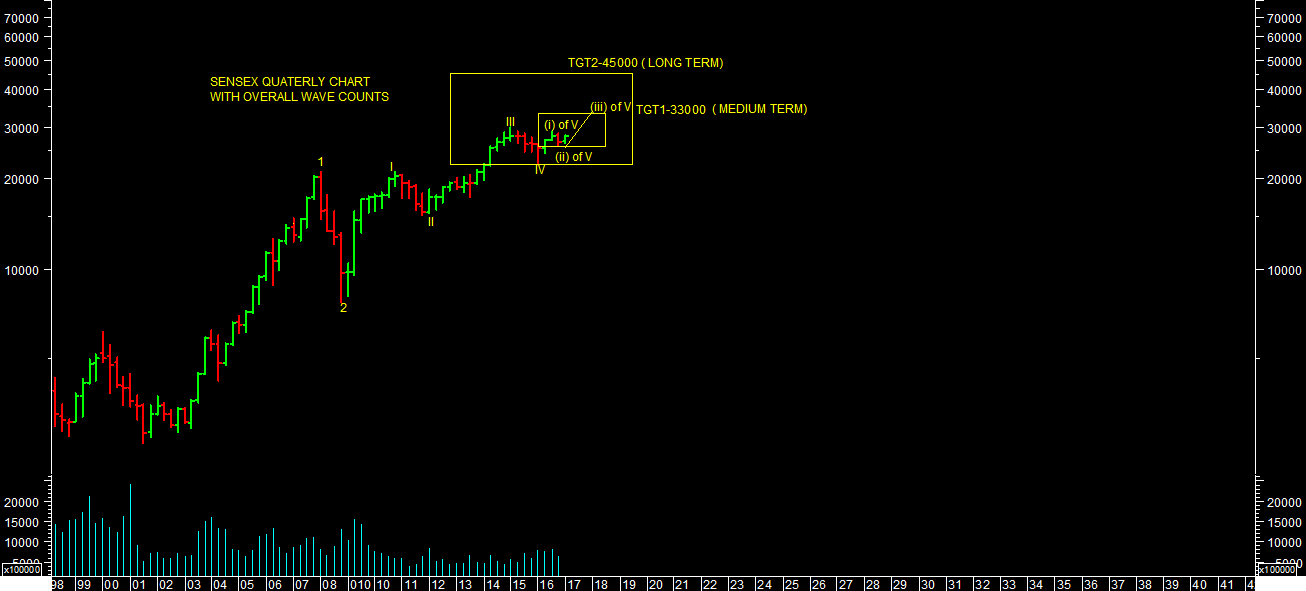

Overall Wave counts are not conclusive. It can be either wave-III or (iii) of V as per quarterly charts attached of nifty & sensex. But conclusively in spite of different wave counts overall view remains bullish for higher levels targets in medium to long term. One can expect target1-10000 levels & taregt2-11800 levels on nifty and for sensex target1-33000 & target2-45000 levels in medium to long term.

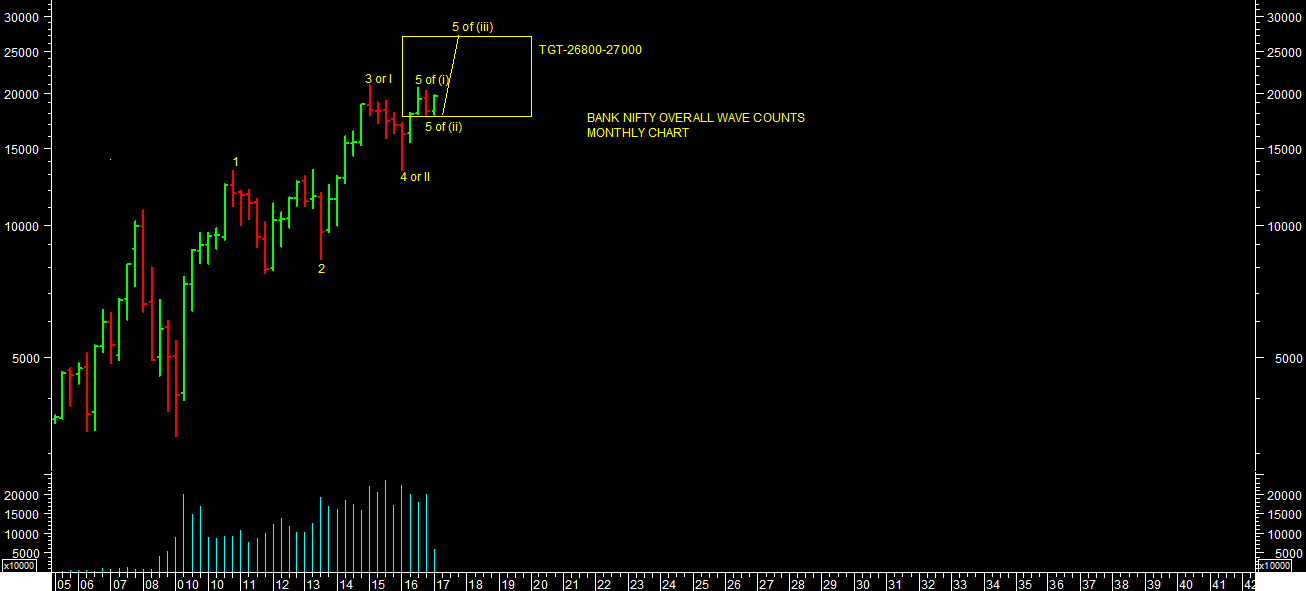

BANK NIFTY also confirmed medium term reversal. It made a low of 16,717 on 26.12.2017. From overall wave counts perspectives, it can be either wave-III of wave (iii) of V (Extended wave-V) as per monthly chart attached. But conclusively in spite of different wave counts overall view remains bullish for higher levels targets till 26800-27000 levels in medium to long term.

As mentioned many times in market outlook column that BUY stock specific on dips which turned out to be favourable for investor, because in current scenario, market has not completed full medium term correction which I anticipated & started to rally further with lower retracement in this correction. But one fact I am reiterating once again that we are in long term bull market so focus of systematic value buying in stocks in any kind of medium term correction or consolidation stage turned out to be reward able in terms of entry opportunity.

7893 levels on nifty & 25,807 levels are strong supports & reversal levels for medium term perspectives till that any kind of correction or consolidation is buying opportunity for higher levels targets in medium to long term.

I think this rally will give the feel of euphoric bubble kind of situation. In which we can see midcap & small cap is going to outperform. One should buy stocks from these sectors to get benefit of the rally. We may also see all of sudden participation from non-performing or weaker stocks also such as PSU BANKS, REALITY, INFRA & some of midcap-Small cap stocks etc to participate in this rally. One should focus to buy quality stocks. Itís very good opportunity to participate in equity market once again as an asset class & be a part of Indian equity Bull market.