Market Outlook

FRIDAY, FEBRUARY 03, 2023

Market Outlook (Closing) as on 03.02.2023

Market closed in positive territory at 60841.88 (+909.64)

SHORT TERM TARGETS ACHIEVED:

SHARP REVERSALFROM MEDIUM TERM SUPPORT/REVERSAL LEVELS:

CONCLUDING SHORT TERM REVERSAL WITH WEEKLY POSITIVE CLOSE:

GLOBAL MARKET PARTICULLARLY USA IS SHOWING SIGN OF EXTENSION OF PULL BACK RALLY WITH BROKEN OUT OF SHORT TERM CONSOLIDATION RANGE:

DERIVATIVE DATA INDICATING LIGHTER POSTION IN OVERALL MARKETS:

ANY KIND OF SHORT TERM CORRECTION OR CONSOLIDATION IS A BUYING OPPORTUNITY FROM LONG TERM INVESTMENT PERSPECTIVES:

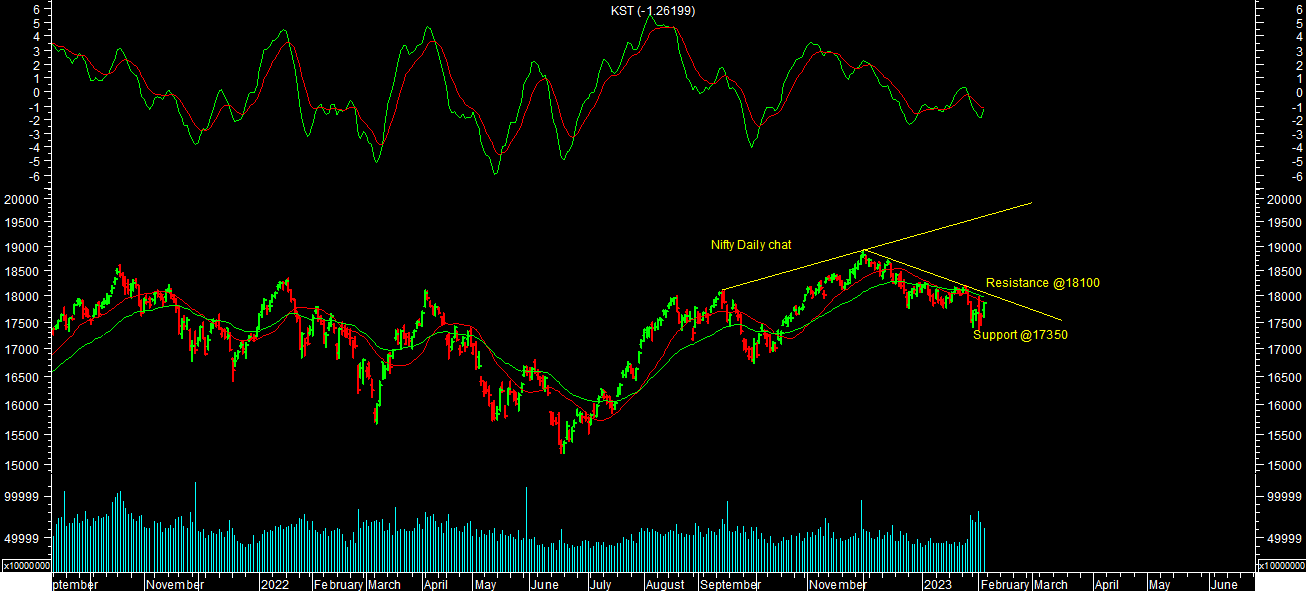

Market was highly volatile with budget & Adani news during the week. It has achieved my short term targets level for this correction near recent lows. It made a low of 17353.40 levels & 58699.20 levels. It sharply from this levels which is also a medium term support/reversal levels as mentioned last week. It looks like end of short term correction with weekly positive close. It has strong resistance @18100 levels on nifty & 60800 levels on sensex in short term. Break of it will be an additional confirmation of short term reversal as per chart attached and we can see sharp rally for higher levels targets in short to medium term. One should BUY stock specific till short to medium term support holds & follow the trend till it reverses.

Overall wave count structure is still bullish as market hold my medium term reversal levels as mentioned below. Taking as wave-(i-ii),(i-ii) possibly as mentioned earlier. Global Markets particularly has broken out of short term consolidation range & showing sign of extension of pullback rally which is good sign for overall of trend of market at current levels.

Bank nifty also closed weekly in positive territory. It also hold medium term support levels. It also looks like end of short term correction on bank nifty. It made a low of 39413 levels in recent correction. We have seen sharp pull back rally from these levels. Short term trend remains UP till it trades above 39400 levels & expecting target of 43000 to 45000 levels in short term. 39400 is crucial support/reversal levels from medium term perspectives till it holds one can expect targets of around 48000 levels in medium term.

17500/18000 is strong support & Resistance levels respectively based on option open interest data for current month series so far from expiry perspectives. Derivative data indicating lighter position in overall markets. Alternatively, It may trade in range of 17400-18100 levels for some more time before give directional break out in short term. 18100 is crucial resistance to watch out in short term for additional confirmation of short term trend.

Momentum indicators Daily KST came in to BUY & Daily MACD is in sell indicating volatility in short term. Break of short term reversal levels will lead to further sharp sell off towards 17000/16700 levels on nifty & 57000/56000 levels on sensex in short term. Investor should use any kind of correction or consolidation to buy stock specific in tranches in disciplined manner from medium to long term perspectives till it reverses.

Momentum Perspective:

Weekly KST & Weekly MACD both are in SELL. Market closed above 20WESM & 40 WEMA. All the evidences are supporting with medium term trend.

Conclusion:

Short Term Trend is UP & Medium term Trend is UP

Trend

Market Outlook (Closing) as on 03.02.2023

Market closed in positive territory at 60841.88 (+909.64)SHORT TERM TARGETS ACHIEVED:

SHARP REVERSALFROM MEDIUM TERM SUPPORT/REVERSAL LEVELS:

CONCLUDING SHORT TERM REVERSAL WITH WEEKLY POSITIVE CLOSE:

GLOBAL MARKET PARTICULLARLY USA IS SHOWING SIGN OF EXTENSION OF PULL BACK RALLY WITH BROKEN OUT OF SHORT TERM CONSOLIDATION RANGE:

DERIVATIVE DATA INDICATING LIGHTER POSTION IN OVERALL MARKETS:

ANY KIND OF SHORT TERM CORRECTION OR CONSOLIDATION IS A BUYING OPPORTUNITY FROM LONG TERM INVESTMENT PERSPECTIVES:

Market was highly volatile with budget & Adani news during the week. It has achieved my short term targets level for this correction near recent lows. It made a low of 17353.40 levels & 58699.20 levels. It sharply from this levels which is also a medium term support/reversal levels as mentioned last week. It looks like end of short term correction with weekly positive close. It has strong resistance @18100 levels on nifty & 60800 levels on sensex in short term. Break of it will be an additional confirmation of short term reversal as per chart attached and we can see sharp rally for higher levels targets in short to medium term. One should BUY stock specific till short to medium term support holds & follow the trend till it reverses.

Overall wave count structure is still bullish as market hold my medium term reversal levels as mentioned below. Taking as wave-(i-ii),(i-ii) possibly as mentioned earlier. Global Markets particularly has broken out of short term consolidation range & showing sign of extension of pullback rally which is good sign for overall of trend of market at current levels.

Bank nifty also closed weekly in positive territory. It also hold medium term support levels. It also looks like end of short term correction on bank nifty. It made a low of 39413 levels in recent correction. We have seen sharp pull back rally from these levels. Short term trend remains UP till it trades above 39400 levels & expecting target of 43000 to 45000 levels in short term. 39400 is crucial support/reversal levels from medium term perspectives till it holds one can expect targets of around 48000 levels in medium term.

17500/18000 is strong support & Resistance levels respectively based on option open interest data for current month series so far from expiry perspectives. Derivative data indicating lighter position in overall markets. Alternatively, It may trade in range of 17400-18100 levels for some more time before give directional break out in short term. 18100 is crucial resistance to watch out in short term for additional confirmation of short term trend.

Momentum indicators Daily KST came in to BUY & Daily MACD is in sell indicating volatility in short term. Break of short term reversal levels will lead to further sharp sell off towards 17000/16700 levels on nifty & 57000/56000 levels on sensex in short term. Investor should use any kind of correction or consolidation to buy stock specific in tranches in disciplined manner from medium to long term perspectives till it reverses.

Momentum Perspective:

Weekly KST & Weekly MACD both are in SELL. Market closed above 20WESM & 40 WEMA. All the evidences are supporting with medium term trend.Conclusion:

Short Term Trend is UP & Medium term Trend is UP

Trend

| Short Term : | Trend | Reversal |

| 62800 |  | 58500 |

| Medium Term : | Trend | Reversal |

| 68000 |  | 58500 |

| Short Term : | Trend | Reversal |

| 18700 |  | 17350 |

| Medium Term : | Trend | Reversal |

| 20400 |  | 17350 |